Economic Outlook 2026

Our Annual Global Economic Outlook was a real success, with a strong turnout that clearly reflected our members’ interest in understanding the global and regional macro environment when it comes to finalising preparations for 2026.

Despite all the political turmoil, markets did well in 2025 overall and continue on a solid path into 2026, with the global economy being quite resilient so far.

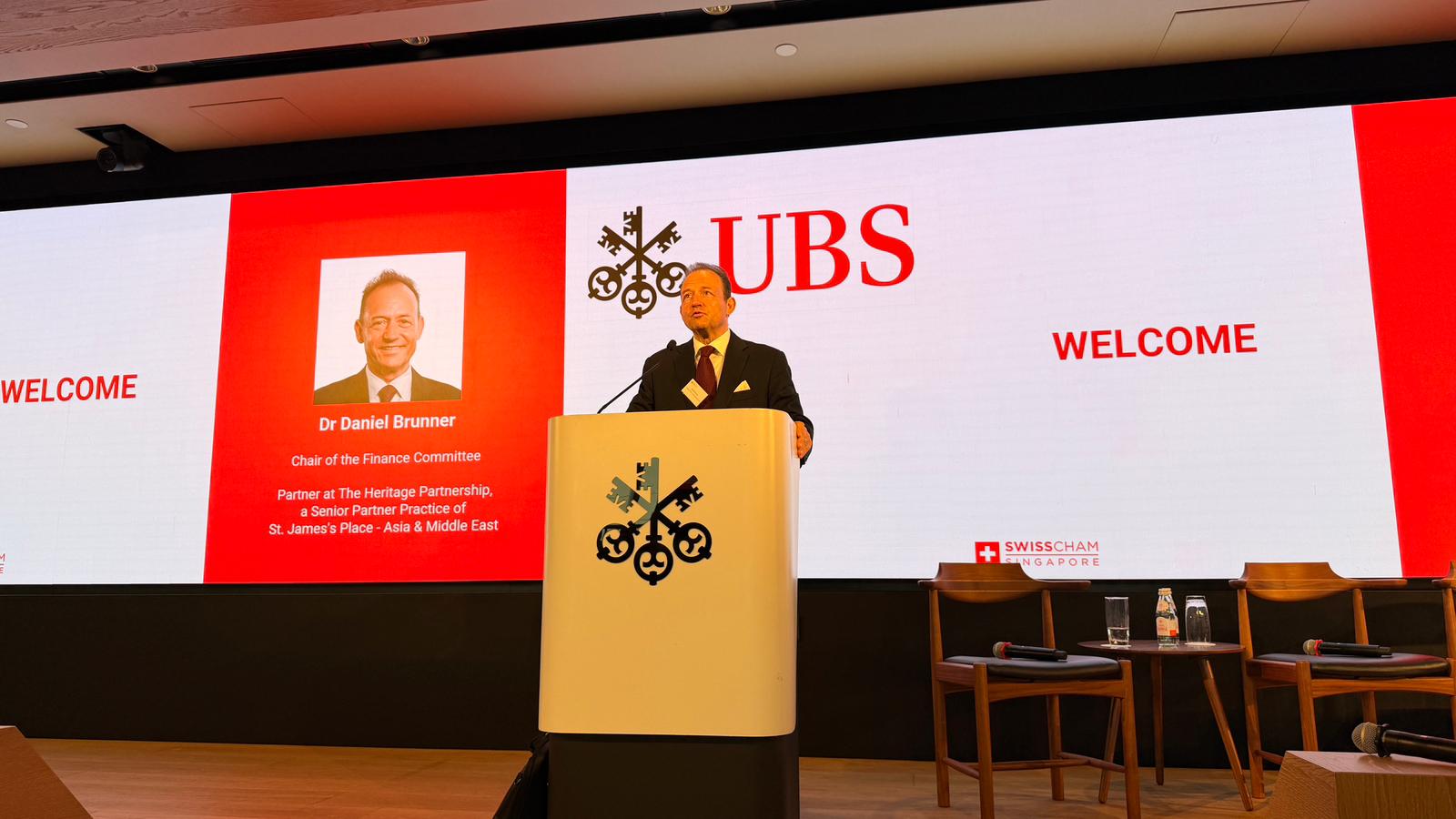

The session opened with a keynote by Hartmut Issel, who was setting the scene with his Global and Asia Outlook. Hartmut highlighted several key political factors to observe, including trade policy developments, Fed leadership and interest rate cut decisions, US midterm elections, and ongoing geopolitical conflicts, all of which continue to shape today’s economic landscape.

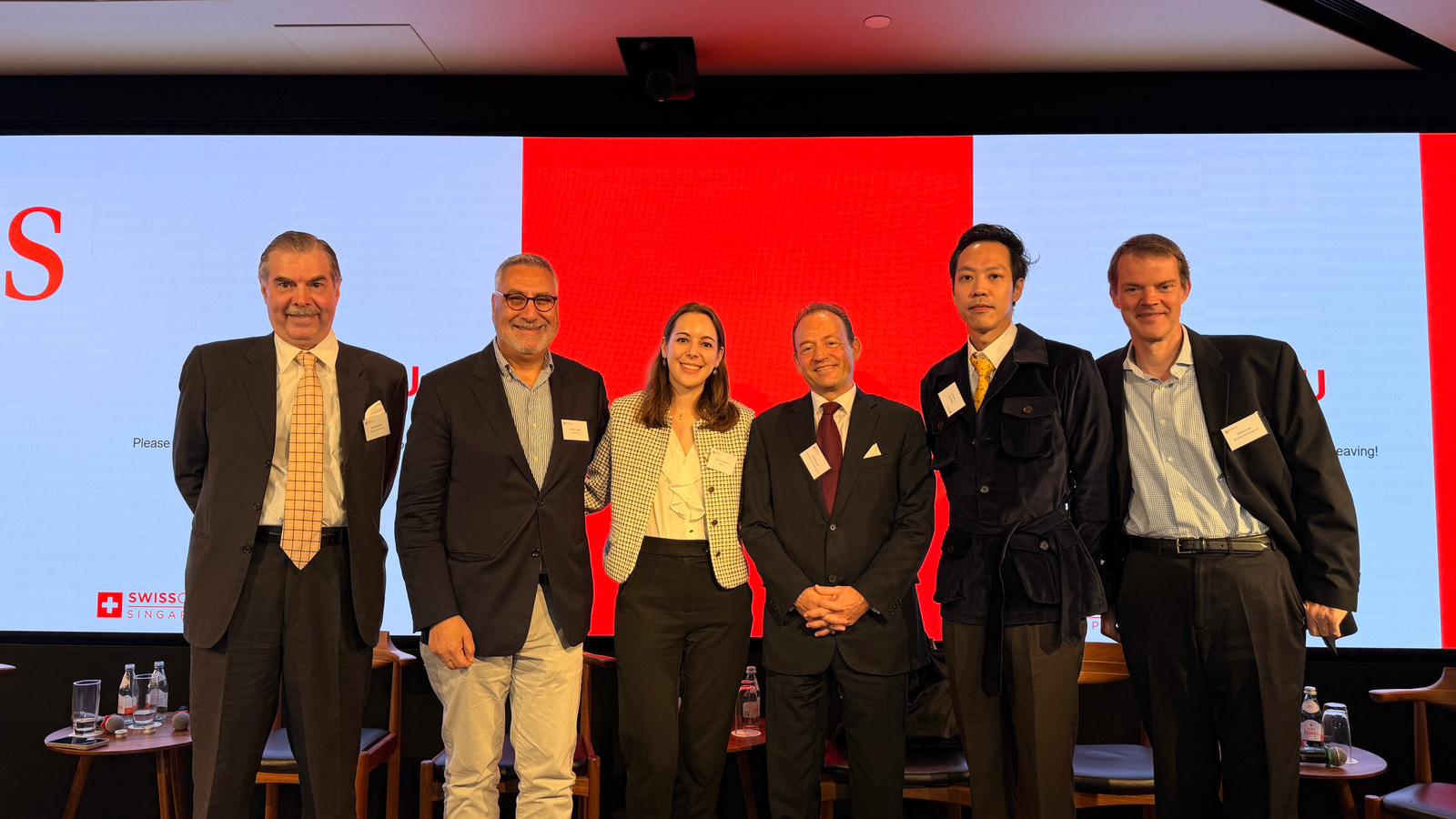

The two Co-Moderators, Dr Daniel Brunner and Bassam Salem, questioned the panelists Eugene Tan, Hartmut Issel, Laeticia Friedemann and Mark Matthews across major markets such as the US, China, India, Japan, Europe and Switzerland, and various asset classes. The idea was to provide guidance to investors and businesses when it comes to their daily decision-making processes.

The session concluded with insightful questions from our active audience, who openly shared the challenges they are facing. This ensured an engaged, rich, and meaningful exchange with our speakers.

A warm thank you to our Finance Committee, chaired by Daniel Brunner, for driving this successful event, and to our Gold Partner UBS for hosting us once again at their auditorium.

A heartfelt thank you also goes to all our speakers for making this session so valuable: Bassam Salem, Eugene Tan, Hartmut Issel, Laeticia Friedemann (representing our Young Professional Community) and Mark Matthews.

And of course, thank you to all the participants for their interest and time